Bitcoin a Safe Haven as Global Equities and Commodities Tumble

On the first week of trading in 2016, U.S. and European markets have fallen markedly. Britain has undergone its worst trading start to the new year in 16 years. China, with a long history of command-and-control economics, has enjoyed recent literature about its more laissez-faire ways, but in times of crisis, the government institutes regulations in order to keep the nation afloat.

In its 25-year history, China’s stock market experienced its shortest day of trading on Thursday. Concerns about capital flight have taken foothold in the world’s second-largest economy.

Thirty minutes after opening, markets ceased trading in order to limit volatility. The Shanghai Composite Index ended its sessions down more than 7 percent at 3115.89. The yuan fell 0.5 percent from its Wednesday rate. Stocks had also fallen throughout Monday.

The yuan fell nearly 1 percent overseas. For the year, the offshore yuan has declined 2.7 percent and is at a record low against the U.S. dollar. The People’s Bank of China stated: “some speculative forces are trying to reap gains from playing [the yuan].”

Such trades “have nothing to do with [China’s] real economy” and precipitated “abnormal fluctuations” in the yuan, the central bank stated.

Because China’s economy is so large, other global currency markets rebalance their currencies so as to negate any benefit that would be felt by Chinese exporters. China, which is often touted as quasi free market, also instituted new regulations, as the Chinese Securities Regulatory Commission declared after trading stopped that shareholders owning 5 percent or more of a listed company are barred from selling more than 1 percent of outstanding shares.

They are also henceforth required to notify exchanges of sales 15 trading sessions prior to execution. This is set to last three months, but the commision is gaining a reputation for renewing old regulations or instituting new ones.

Oil prices and the U.S. stock market acted ahead of China’s steep decline on Thursday, as the Dow Jones Industrial Average declined to a three-month nadir, declining 252.15 points, or 1.5 percent, to 16906.51. That’s the lowest close since October 6.

The price of U.S. crude oil declined 5.6 percent. The S&P 500 fell 26.45 points, or 1.3 percent to 1990.26. Nasdaq fell 55.67 points or 1.1 percent to 4,835.76.

European stock markets also suffered a “rollercoaster” ride this week. Britain endured its worst new yearstart to trading in 16 years.

Mike van Dulken, of Accendo Markets, told The Telegraph: “Gold is still attempting to break out beyond two-month falling highs around $1,075 as it benefits from safe-haven demand amid market volatility and geopolitical risk.”

Amid the chaos, Bitcoin has firmed its bearings at $450, acting in much the same way it usually does when stocks become volatile as they have across the globe in the first week of trading.

Although engulfed in a bit of a “constitutional crisis,” Bitcoin appears to enjoy healthy demand in times of crisis, almost acting as a safe haven asset as investors call commodities and investments that do well in times of uncertainty.

Not only has the raw Bitcoin price done well in the new year, but so too has the public market-based Bitcoin Investment Trust (GBTC).

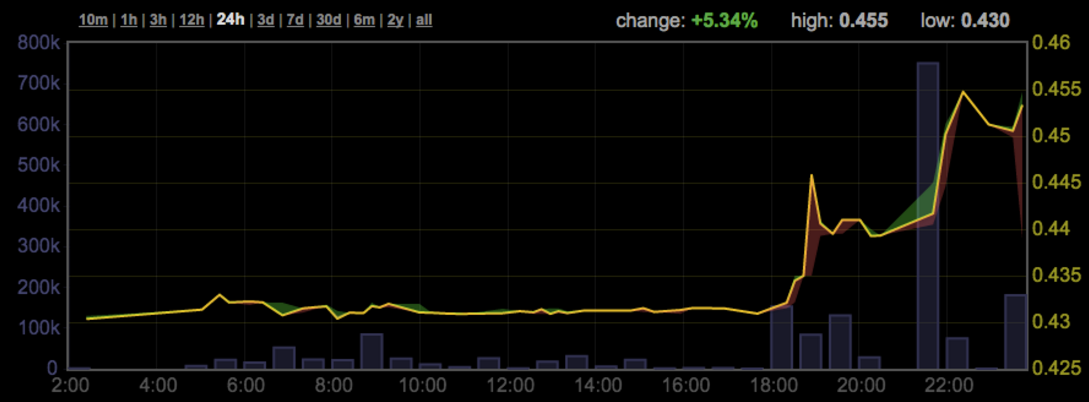

The Winklevoss twins’ Gemini Exchange has seen a spike in trade volume in the past 24 hours. So, it appears that, while global stocks panic, those based in Bitcoin sustain the crisis quite handsomely.

The shaky markets could be fallout from the U.S. Federal Reserve’s recent small increase in the interest rate .25 percent from December when it raised the benchmark interest rates for the first time in almost 10 years.

The Federal Reserve called its December decision a “close call.”

The Fed said:

In the economic forecast prepared by the staff for the December FOMC meeting, real GDP growth in the second half of this year was little changed, on net, relative to the projection for the October meeting. The staff’s medium-term projection for real GDP growth was revised up slightly, on balance, from the previous forecast, primarily because the recently passed Bipartisan Budget Act of 2015 was anticipated to lead to somewhat higher federal government purchases.

As a result of the recently passed Bipartisan Budget Act, federal spending was expected to provide a modest boost to economic activity over the next few years.

The Fed made the entire world nervous by keeping interest rates low for nearly a decade. This built anticipation inside the global investor that, once interest rates raised, this forebode economic uncertainty.

Perhaps this is what is now playing out in the beginning of 2016, perhaps not. Nobody knows what the Fed’s decision regarding raising interest rates will have. Commodities are continuing to fall, which hurts many nations and global producers, including the so-called “BRICs” who were supposed to power the global economy through the recession.

Photo 2 dogs / Flickr(CC)

The post Bitcoin a Safe Haven as Global Equities and Commodities Tumble appeared first on Bitcoin Magazine.