Bitcoin Price Analysis: Choppy Market Conditions Lead to Tests of Parabolic Resistance

The bitcoin market has been getting chopped to pieces for weeks as the market has faked up, faked down, consolidated and routinely stopped out traders. Last week, we discussed a potential large move due to a consolidated symmetrical triangle. However, the breakout failed to garner any momentum and ultimately flopped as the move upward quickly died down and ultimately reversed.

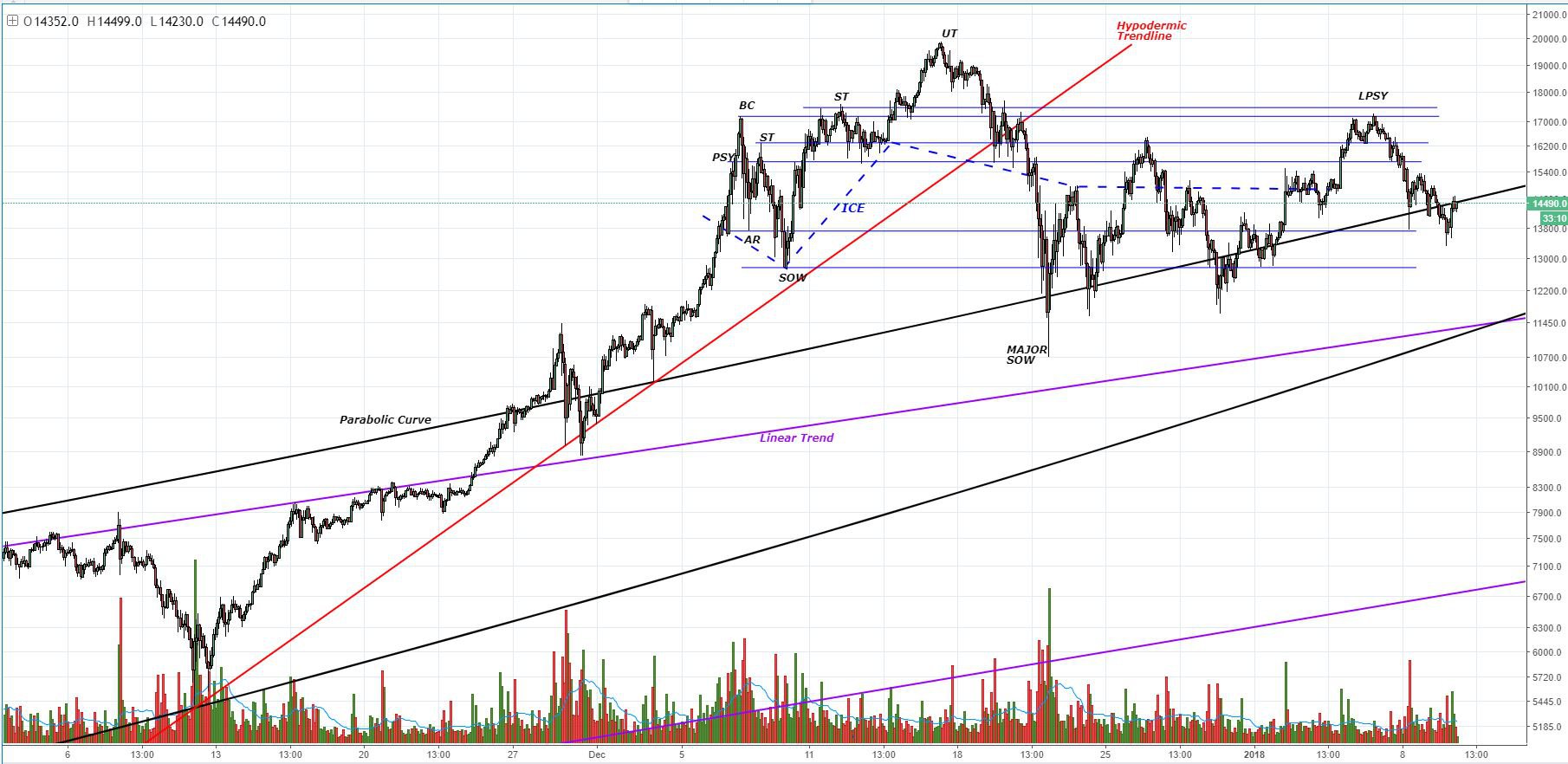

At the time of this article, however, the market is poised in a precarious situation as it tiptoes around historic support/resistance along the parabolic envelope: Figure 1: BTC-USD, 2-Hour Candles, Parabolic Curve Test

Figure 1: BTC-USD, 2-Hour Candles, Parabolic Curve Test

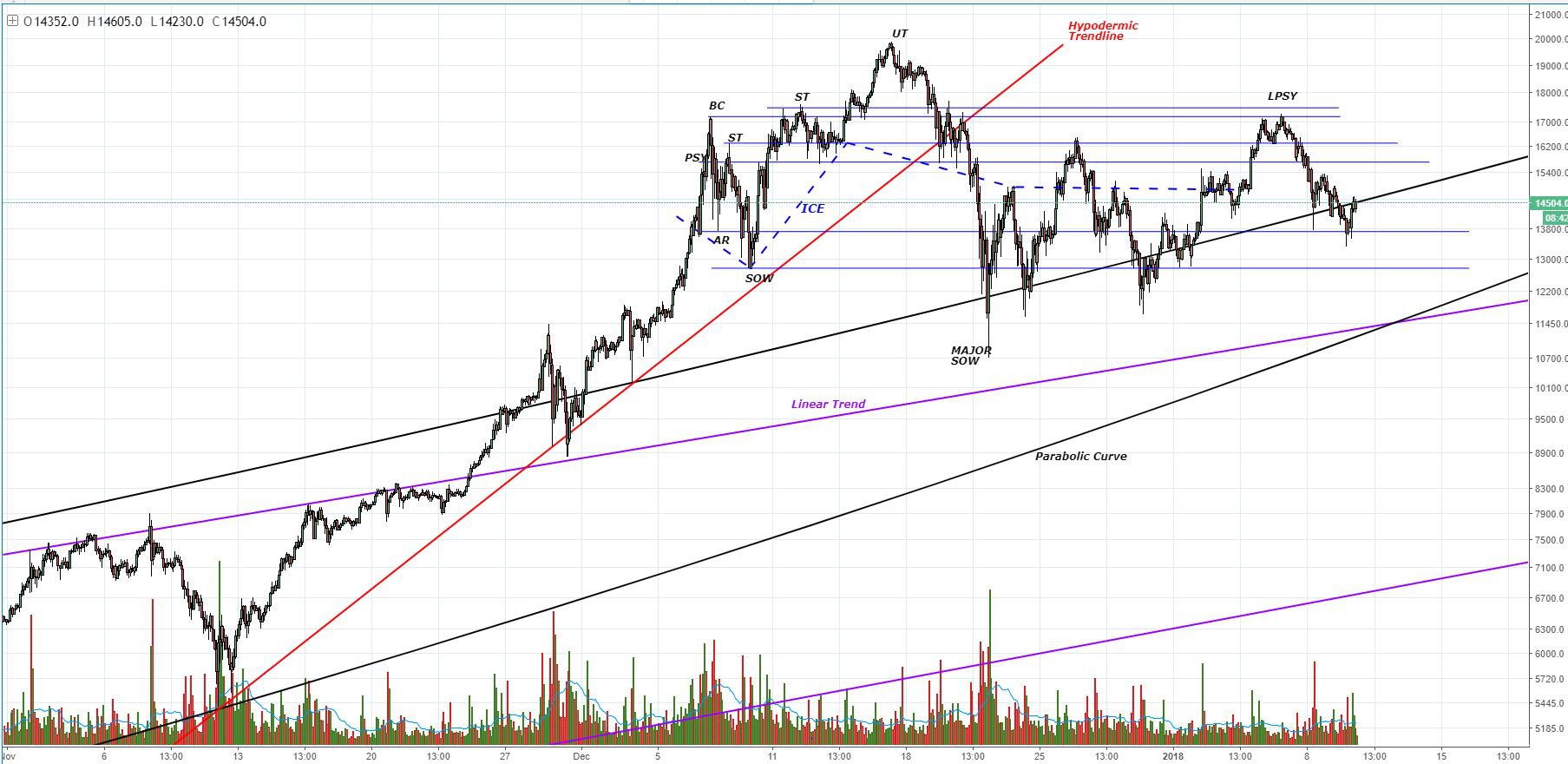

As noted in previous bitcoin analyses, this parabolic envelope has been the dominating trend for the last three years:

Figure 2: BTC-USD, 1-Day Candles, Macro Trend

Figure 2: BTC-USD, 1-Day Candles, Macro Trend

Over Thanksgiving, the parabolic trend that was previously governing much of the three-year bull market broke upward as the market’s parabolic movement accelerated aggressively upward. Since the break to the top of the parabolic envelope, the market has been on shaky ground where, at one point, it even did a massive 50% retracement. Since that aggressive retracement, the market has yet to fully recover and resume any semblance of a bullish continuation. Currently, the once-supportive parabolic curve is now proving to be a point of resistance as the market has made several tests of the upper resistance.

To date, this marks the fifth test of the parabolic trend. This time, however, we are testing it from the bottom of the parabola. Previous tests from the top side of the parabola were swiftly rejected causing very little market activity to take place below the parabolic trend. It seems, yet again, bitcoin is at a crossroads as it decides if the upper parabolic resistance is too strong to resume an uptrend.

If the market continues downward, we can expect to find support along the low boundaries of the trading range (shown in blue), the linear trend (shown in pink) and the lower parabolic curve (shown in black):

Figure 3: BTC-USD, 2-Hour Candles, Next Lines of Support

Figure 3: BTC-USD, 2-Hour Candles, Next Lines of Support

Summary:

-

Choppy market conditions have led bitcoin to test the parabolic support — a previous guiding trend for the last three years.

-

A failure to break the upper parabolic resistance may cause a test of lower values.

-

Support will be found at the lower ranges of the trading range and along the linear and parabolic trend lines.

Trading and investing in digital assets like bitcoin and ether is highly speculative and comes with many risks. This analysis is for informational purposes and should not be considered investment advice. Statements and financial information on Bitcoin Magazine and BTC Media related sites do not necessarily reflect the opinion of BTC Media and should not be construed as an endorsement or recommendation to buy, sell or hold. Past performance is not necessarily indicative of future results.

The post Bitcoin Price Analysis: Choppy Market Conditions Lead to Tests of Parabolic Resistance appeared first on Bitcoin Magazine.