Bitcoin Price Analysis: Crucial Tests of Historic Support Could Lead to Further Pullbacks

This week’s BTC-USD price recap:

Following a $700 drop, BTC-USD managed to find a bottom around $4200 before entering into a 4-day long consolidation pattern. During the consolidation pattern, the price climbed $400 on decreasing volume before ultimately dropping back to $4200. So, where does this leave us and what can we expect in the coming days in the BTC-USD markets?

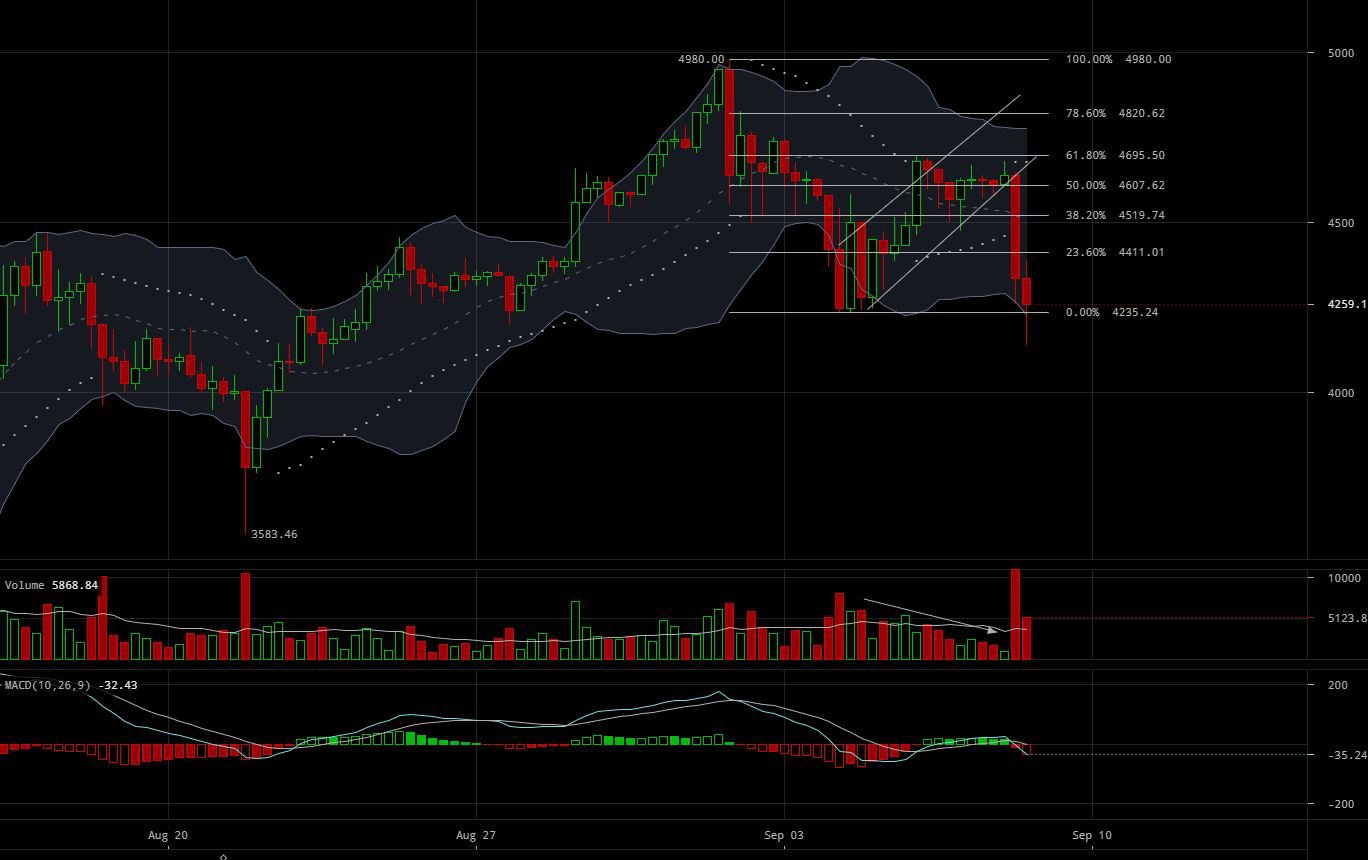

Figure 1: BTC-USD, 1-Hour Candles, GDAX, Bear Retracement Values

Figure 1: BTC-USD, 1-Hour Candles, GDAX, Bear Retracement Values

A common continuation pattern during bear markets is a step-by-step series of tests along the Fibonacci Retracement set. One by one, the Fibonacci values are tested before the retracement ultimately tops out around 61%. During the climb to 61%, a bearish continuation is supported by a decreasing volume trend. In the figure above, we can see the BTC-USD market managed to retrace up to the 61% values before dropping to the 0% retracement values in the $4200s. The drop to test the $4200s was sudden and violent: It took place over a few short hours, and the volume propelling the drop was massive.

Figure 2: BTC-USD, 6-Hour Candles, GDAX, Macro Bear Flag

Figure 2: BTC-USD, 6-Hour Candles, GDAX, Macro Bear Flag

Prior to the breakout, the BTC-USD market spent a week forming a bearish continuation pattern called a Bear Flag (the details regarding a Bear Flag was discussed earlier in this week’s ETH-USD article). The price target of this Bear Flag is an approximate $700 move and is projected to touch the $3900s. However, our current price level is sitting right on top of historic support along the macro trend’s 23% Fibonacci Retracement values: Figure 3: BTC-USD, 6-Hour Candles, GDAX, Macro Trend Fibonacci Values

Figure 3: BTC-USD, 6-Hour Candles, GDAX, Macro Trend Fibonacci Values

Our current price level is sitting on an historically significant support level so whether or not we manage to break this support remains to be seen. When trading this pattern, it is important to confirm the movement with volume. When testing historic support or resistance values, it is common to see multiple tests before ultimately breaking through. To date, this represents our third attempt to break this support and it is currently testing it on a volume that is peaking on the 6-hour candle’s volume trend.

Summary:

-

Following a $700 drop to $4200, BTC-USD managed to climb $400 before ultimately retesting the $4200 support.

-

On the macro bear trend, BTC-USD broke out of a multi-day long Bear Flag. This Bear Flag has a price target of approximately $3900.

-

BTC-USD is currently testing the macro 23% Fibonacci Retracement. This support has strong historic significance and will need to be broken in order for the Bear Flag’s price target to be realized.

Trading and investing in digital assets like bitcoin, bitcoin cash and ether is highly speculative and comes with many risks. This analysis is for informational purposes and should not be considered investment advice. Statements and financial information on Bitcoin Magazine and BTC Media related sites do not necessarily reflect the opinion of BTC Media and should not be construed as an endorsement or recommendation to buy, sell or hold. Past performance is not necessarily indicative of future results.

The post Bitcoin Price Analysis: Crucial Tests of Historic Support Could Lead to Further Pullbacks appeared first on Bitcoin Magazine.