Bitcoin Price Analysis: Expect Some Lower Lows Before the Next Bounce

Two days ago, I outlined a potential BTC-USD price breakdown due the broken hypodermic trendline. Since then, the price has dropped nearly $7,000 and is showing signs of further downward continuation. Let’s take a look at the chart from the last BTC-USD market analysis:

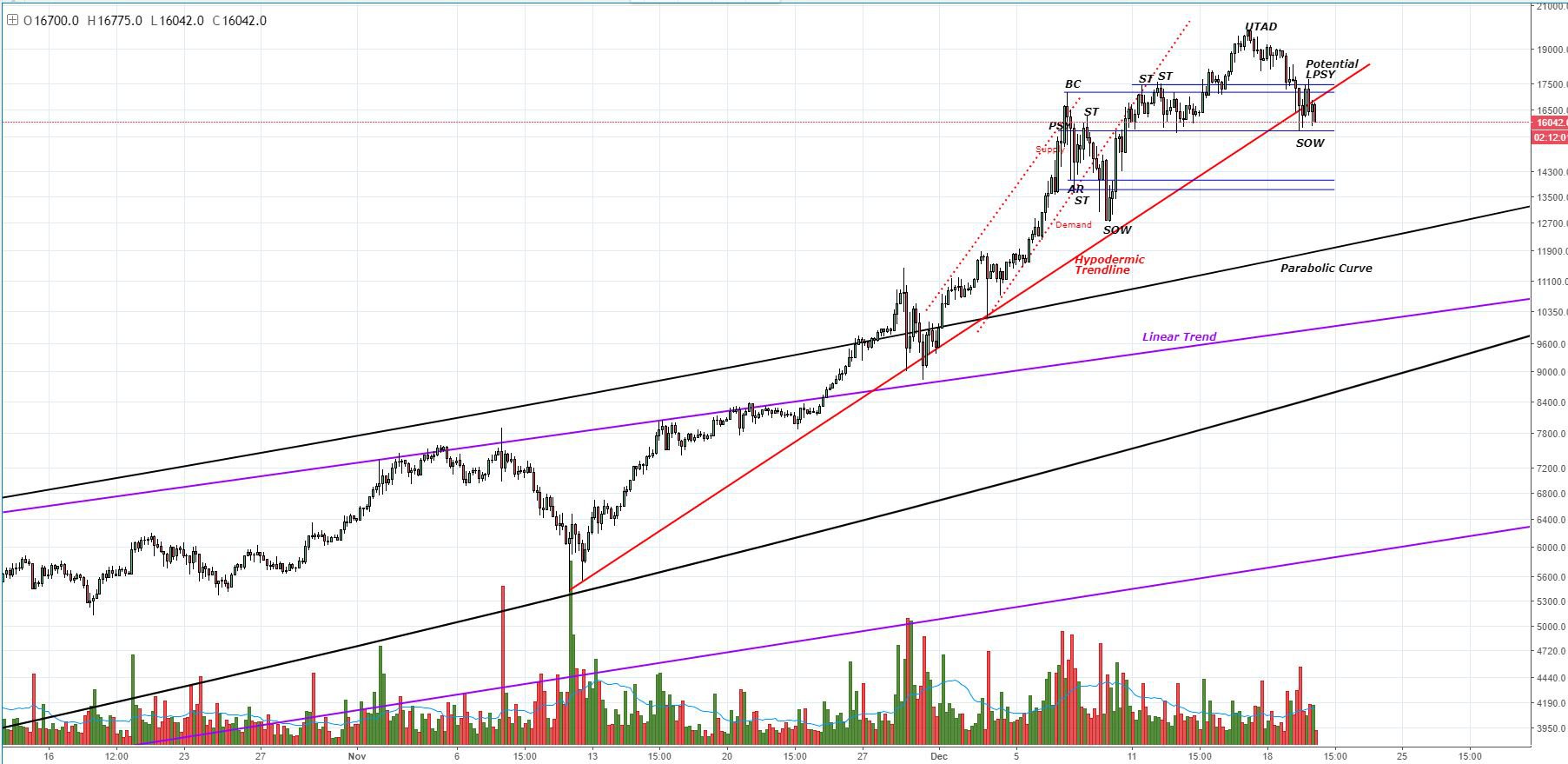

Figure 1: BTC-USD, 4-Hour Candles, Trend Prior to Breakdown

As you can see, the price was holding on by a thread near the red, hypodermic trendline. Once it managed to break this trend, the price immediately and aggressively dropped. Thus, the market signaled the end of the current parabolic breakout. Currently, it is finding support on the parabolic curve; but on the lower timescales, it shows signs it might take one last move downward before a proper bounce occurs. Since the hypodermic trend occurred once the market broke the linear trend, there is likely going to be very strong support there:

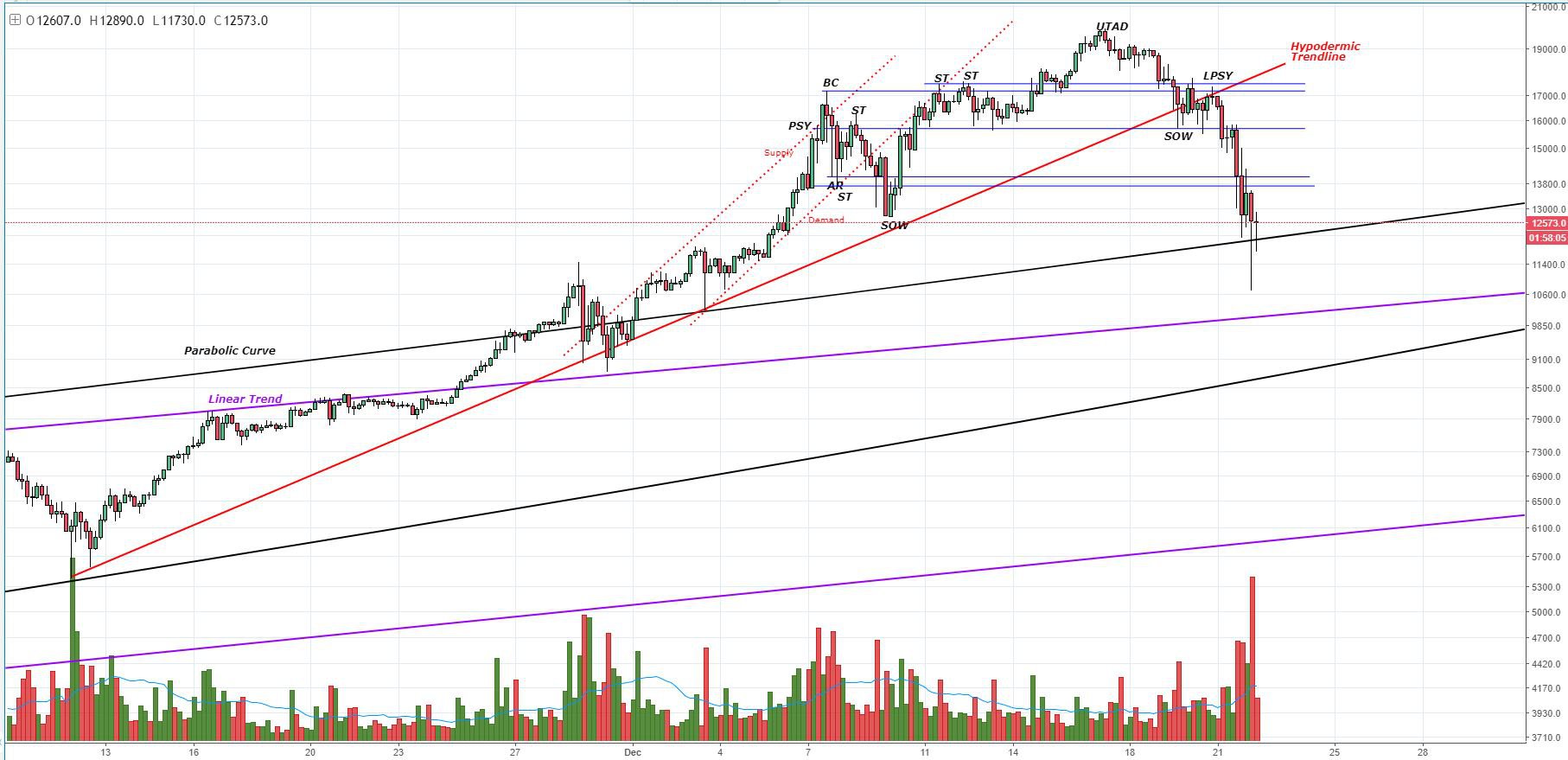

Figure 2: BTCU-SD, 4-Hour Candles, Hypodermic Breakdown

In the event that BTC-USD sees new lows, we can expect solid support in the upper $9900s to low $10,000s. From there we will likely see a bounce leading to a consolidation period, where the market will ultimately decide if it wants to resume the downtrend or break upwards. Given the fact that we broke out of a distribution trading range, it is likely that we will resume this down trend after any potential consolidation.

Distribution is the top of the market cycle and leads to a markdown in price once the trading range is broken. However, this is all up in the air right now and we will still have to see how bitcoin handles the next phase of consolidation. For now, I don’t anticipate any radical lows ranging beyond the linear trend support shown above.

At this point, it doesn’t appear we have reached a selling climax. Although the selling has been intense, there is nothing terribly notable on the macro view of last nights aggressive moves:

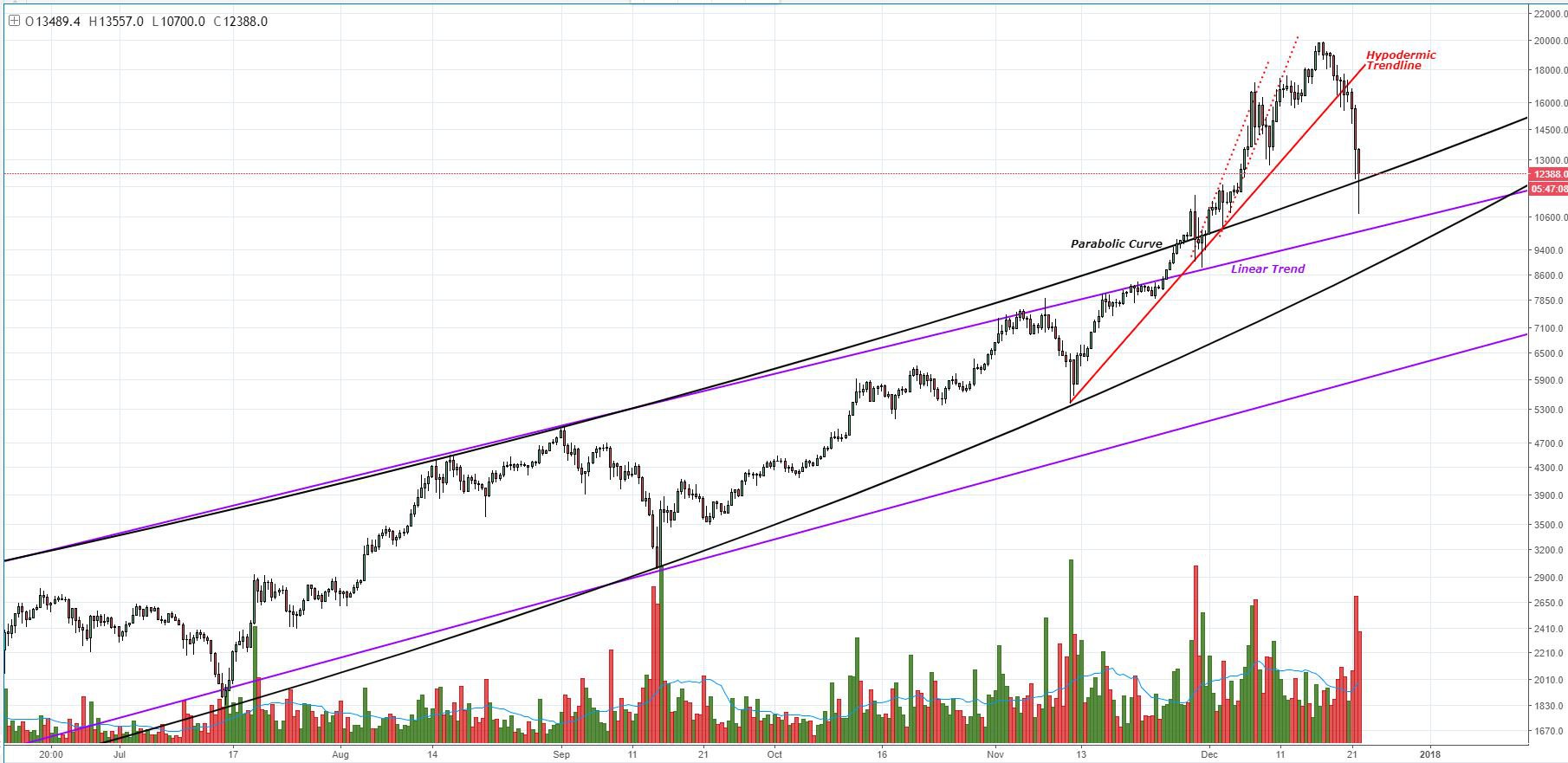

Figure 3: BTC-USD, 12-Hour Candles, Macro Volume

There was a lot of volume during last night’s moves, but there wasn’t a selling climax that would notably mark what we would expect from such a fantastic drop in price. Maybe I’ll be proven wrong, but I’m anticipating lower lows in the coming days and weeks.

Summary:

-

Bitcoin broke down out of its hypodermic trend.

-

It is currently finding support on its macro parabolic trend.

-

Another shove downward is likely, but I believe it will lead to a bounce to a medium-term consolidation period.

Trading and investing in digital assets like bitcoin and ether is highly speculative and comes with many risks. This analysis is for informational purposes and should not be considered investment advice. Statements and financial information on Bitcoin Magazine and BTC Media related sites do not necessarily reflect the opinion of BTC Media and should not be construed as an endorsement or recommendation to buy, sell or hold. Past performance is not necessarily indicative of future results.

The post Bitcoin Price Analysis: Expect Some Lower Lows Before the Next Bounce appeared first on Bitcoin Magazine.