Bitcoin Price Corrects; What’s Next?

This morning we noted in our twice daily bitcoin price watch piece that we were looking at a slightly tighter time frame than normal, purely because the action in the bitcoin price throughout the early session and been volatile, and that it would warrant a closer timeframe to ensure we keep our stops tight enough to avoid large losses. Contrary to common belief, zooming in on a tighter timeframe during periods of volatility can help control the risk we expose ourselves to – this is the root of all scalp strategies. As we head into the Asian session this evening, we are going to widen back out to the 15-minute timeframe, with the goal of taking advantage of the today’s corrective momentum. So, with this said, here’s what we are watching this evening, and a description of how we are looking to define our risk moving forward. As always, take a quick look at the chart.

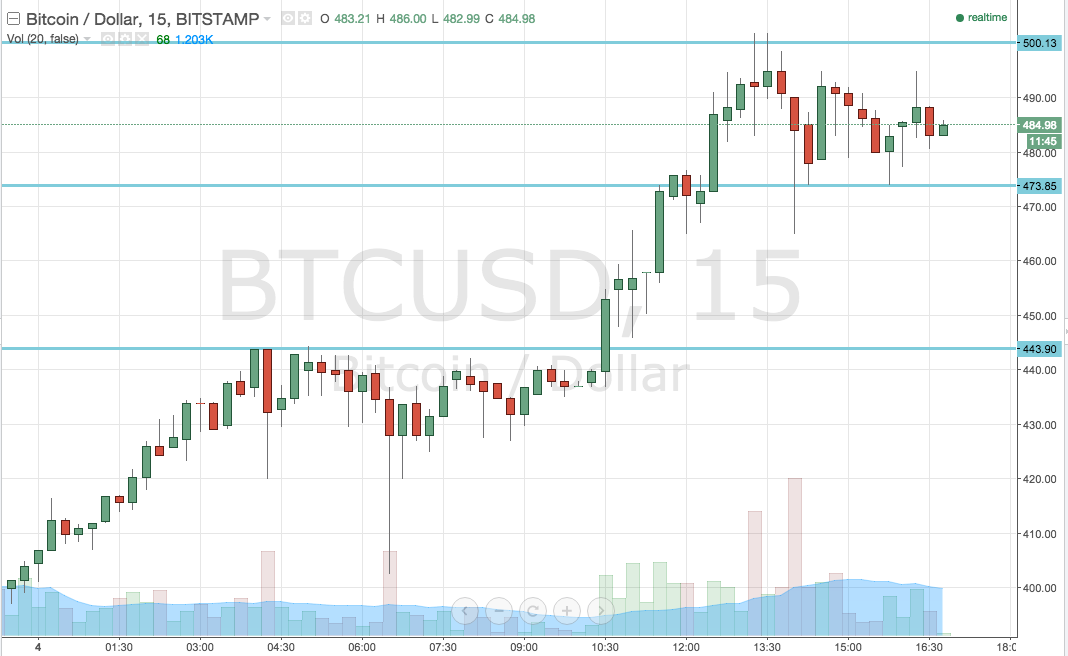

As the chart shows, in term support for tonight’s session sits at 473.85, while in term resistance holds at a little over 500 flat. With this wide a range, we are able to bring both our intrarange and our breakout strategy into play tonight.

We will initially look from a bounce off support to put us in a long trade towards in term resistance at 500 flat. On this one, a stop just the other side of our entry (around 440 flat, validates the trade from a risk management perspective.

If we break support, we will look short towards 443.90 longer term, with a stop around 476 flat. Bear in mind that this goes against the overarching momentum, so a trailing stop might be a handy addition to the position.

Looking to the upside, a break above (and a close above) in term resistance at 500 flat will validate a long entry towards 510, with a stop around 495 giving us a two to one risk profile.

Charts courtesy of Trading View

The post Bitcoin Price Corrects; What’s Next? appeared first on NEWSBTC.