Globalizing Digital Currency — Trends, Gaps, Opportunities

This is a guest post by Michael Haley, Operations Manager at AlphaPoint.AlphaPoint is a financial technology company that powers digital currency exchanges and provides institutions aggregate access and order routing to digital currency markets.

Right now, there are active digital currency markets running 24/7 in at least 45 national currencies.1 That is, there are digital currency markets in one quarter of the 180 national currencies recognized as legal tender by the United Nations. 2 Seven years into the onrush of Nakamoto’s protocol, we think it makes sense to ask: Why does this matter? Why is closing the gap on the remaining three quarters important? What opportunities reside there?

Why It Matters

It matters in the first case because the geographic distribution of these markets is misaligned with the distribution of bitcoin market potential. At any given point in time, it is difficult to establish a bead on the aggregate global exchange count. Small exchanges crop up with little media presence and volunteer-run indexes have difficulty staying current.

The pattern, nevertheless, is clear enough: Europe and North America are each serviced by more than 30 exchanges, and East Asia by roughly 20, concentrated in China. Conversely, South Asia, Africa, the Middle East, and Latin America have nothing approaching this density. Further, exchange volumes today correlate with exchange count, with the staggering majority of digital-fiat conversion hosted in the Chinese yuan, U.S. dollar, and euro. The overwhelming majority of bitcoin-fiat trades is against the yuan, virtually all of it at zero-fee exchanges, creating masses of volume whose validity is difficult to pinpoint.3 Beyond this, American dollars and euros come second and third, respectively. Other currencies in aggregate scarcely register.

1 This number is per publicly available data from bitcoin charts , Bitcoin Average , bitcoinity , Coin Market Cap , and elsewhere. An asterisk: Of course there are national markets for Litecoin, Ripple, and the like, and of course there are reasons to believe DAAP coins will become a bigger part of volumes in the near future. But the fact remains that Bitcoin’s market capitalization dwarfs that of its competitors. Currently BTC capitalization is fifteen times that of XRP. And of course there are informal and P2P markets for digital tokens of all kinds. But here I am defining ‘active markets’ as those serviced by at least one order matching service (one exchange), because informal markets tend to be erratic, illiquid, and difficult to quantify. 2 Source: United Nations Treasury 3 See, e.g. “80% of bitcoin is exchanged for Chinese yuan ” (Mar. 10, 2015 -Quartz)

And yet, digital currency’s greatest mainstream potential and most compelling use cases tend to reside outside of North America, Western Europe, and East Asia.

Instead, the greatest potential beneficiaries tend to be concentrated in national markets whose fiscal, political, and infrastructural histories have rendered basic financial services out of reach for many businesses and individuals: Venezuela, Zimbabwe, Belarus, etc.

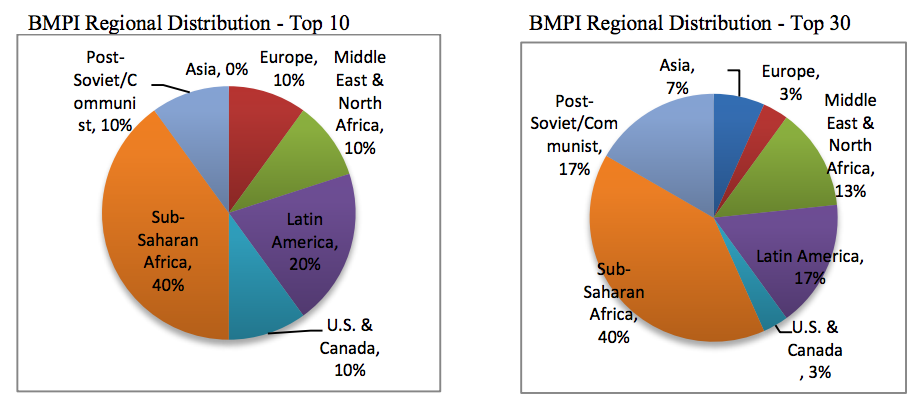

Economist Garrick Hileman provides a useful snapshot of this distribution in his Bitcoin Market Potential Index (2014). Of the highest-ranking markets in the index, more than half are based in sub-Saharan Africa and Latin America. Likewise, there are indicators that regulatory clarity is improving in these regions — in Chile and Nigeria particularly — at the same time beneficial frameworks continue to elaborate themselves in more established hubs — places such as Singapore, the United Kingdom, or Luxembourg.4

“We’re working in markets where it’s impossible for companies to sell online without giving away more than 5 percent of their business to payment processors,” said Gabe Abed, co-founder and CEO of Bitt, a non-bank financial institution (NBFI) and universal Bitcoin services firm based in the Caribbean. “Individuals sending money from one island to another routinely lose 12 percent on fees. Credit card acceptance is low, and yet there’s a very high penetration rate for mobile Internet — so there’s this gap, which is precisely what we’re aiming to fill.”

Opportunities Across Global Markets

This gap between solutions offered by legacy systems and those made possible by the blockchain is falling into sharper relief for consumers and enterprises alike, and the opportunity is massive.5

4 Thanks to Adam Vaziri, Director at London-based DIACLE, for his input. 5 Particularly given how closely exchange distribution correlates with the distribution of the network itself and of merchant adoption.

To put matters in perspective: More than 50 countries host over $1 billion in daily foreign exchange volume. 6 In sum, there is more than $5 trillion in global FX trading per day. Even 1 percent of this total is $50 billion — more than 1,500 times the current daily total for digital currency trading.

“In the Bitcoin community, we’re used to talking about underbanked people,” said Gabriel Miron, CEO of Mexico City-based meXBT. “But more and more, we’re finding that underbanked businesses are key.” In moving funds between Mexico and, say, China or Brazil, banks perform FX conversion at a loss through the U.S. dollar. “And if you’re not one of a bank’s largest customers, this process can take weeks. Using bitcoin as the rails, we can settle in under 24 hours. Existing bank infrastructure can’t get close to that.”

“We’re seeing that larger firms are particularly interested in more efficient settlement,” said Jesse Chenard, founder and CEO of MonetaGo, adding that smaller enterprise clients are more interested in availing arbitrage opportunities in bitcoin markets to drive down fees. “On a recent $13,000 intracompany transfer, we saved the client $600 in fees they would have otherwise had to pay to Bank of America.” In so many words, the needs and corresponding solutions are diverse, a point recently echoed by Andreas Antonopoulos.7

Globalizing Digital Currency — Trends, Gaps, Opportunities

The opportunities we see can be spaced across two fronts: (1) making digital currencies more widely available, and (2) leveraging them to streamline international transfers. Yet we see these as part of the same movement, as two sides of the same coin — both predicated on active, stable markets across effectively all national currencies.

More often than not, the speed and cost benefits offered by digital currency will be most dramatic in south-south transfers (between countries in Africa, Latin America, South Asia, etc.), where bitcoin (or other digital currencies) can facilitate FX conversion without needing to move through the U.S. dollar, radically reducing both costs and settlement times.

BitNodes and CoinMap , respectively. We would argue the connection is not simply correlative but causal, that mining and exchanges are preconditions for broader use. 6 Source: Bank for International Settlements Triennial Survey (April 2013) 7 IDEO Futures podcast Episode 21.5 (August 2015)

As markets expand and access improves, and as regulatory frameworks fall into sharper relief, we believe more and more businesses and individuals will recognize these benefits, that south-south trade will help drive adoption forward in the months and years ahead, and that this demand will help make digital currencies more available to the populations that stand to benefit from them most.

The post Globalizing Digital Currency — Trends, Gaps, Opportunities appeared first on Bitcoin Magazine.