Latest SEC Hearing into Cryptocurrencies Offers Glimmer of Light

The U.S. Securities and Exchange Commission (SEC) has been relatively stringent in its views of both security and utility tokens. The organization is seeking to label all virtual tokens originally distributed through initial coin offerings (ICOs) as securities, which would subject them to very strict regulatory practices and potentially have massive repercussions on their prices.

One of those tokens is ether, which was originally distributed and marketed through presales. Members of the Venture Capital Working Group — an organization comprised of lawyers, investors and cryptocurrency experts working to block the SEC’s decision — argue that ether has become so decentralized, it can no longer be looked at as a security, and should thus be exempt from securities-related laws. Ether is the world’s second-largest cryptocurrency by market cap after bitcoin.

April 26, 2018, marked an important step in the fight for “token rights.” A congressional hearing with testimony from the SEC’s Division of Corporation Finance (the organization directly responsible for establishing token policies) took place to potentially develop more reasonable approaches toward token sales and their classifications.

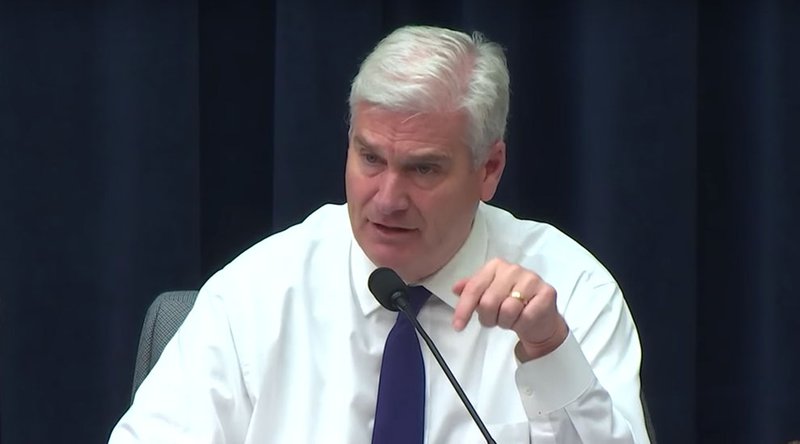

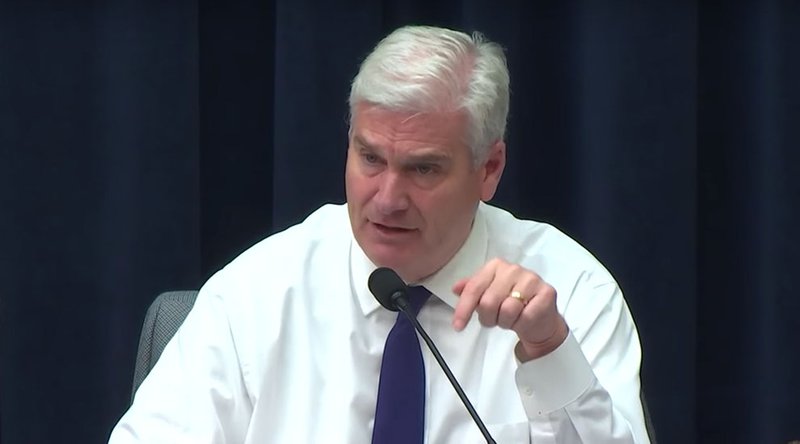

Minnesota Representative Tom Emmer led the discussion with SEC division head William Hinman. Throughout the hearing, Emmer voiced his support for cryptocurrency entrepreneurship and innovation, stating, “People tend to fear what they don’t know. If people sailing the oceans at the time of Columbus had believed the world is flat, we wouldn’t have had the great discoveries of the New World.”

The discussion marks a new attitude amongst SEC members. Chairman Jay Clayton has reported in the past that he wants to see all tokens registered through ICOs be classified as securities in the future, but Hinman assured listeners that representatives are trying to view the situation openly and see which entities might exhibit utility-based behaviors.

During the hearing, Rep. Emmer asked Hinman, “Is it possible that a utility token would not be a security because it’s not done for capital formation?”

Hinman replied that it ultimately was possible, as there are tokens that do not have the “hallmarks” of a security. Additionally, he stated that many fundraisers are intended to “develop networks” where a token is strictly intended for use as a buying mechanism for goods or services.

“We can certainly imagine a token where the holder is buying a token for its utility, not as an investment,” Hinman continued. “Especially if it’s a decentralized network where it’s used, and not central actors where there would be information asymmetries where they would know more than token investors.”

In a recent panel discussion during the Distributed: Markets Conference in Chicago, Tennessee blockchain lawyer Gray Sasser of Frost Brown Todd explained that while the SEC has been relatively straightforward in saying where tokens should fall, it has not done a good job of guiding distributors or token builders.

This has been a recurring point of concern. Emmer echoed this sentiment, asking how regulation in the U.S. can be better clarified for U.S. investors. He queried whether it was possible to assist crypto-related business developers to better understand their contributions to tokens that may not be securities, thus avoiding SEC enforcements.

Hinman — likely referring to the Venture Capital Working Group — replied that one of the steps the SEC was taking was “meeting with participants that have these ideas of a token that shouldn’t be regulated as a security” and working with them on how they should be structured. Hinman pointed out that the SEC is heavily engaged in academics, industry and other departments to better explore how everything might work, and that in the long run, the U.S. is “pragmatic” in its support of new technology.

Unfortunately, the hearing also shed light on the lack of education among American leaders concerning cryptocurrencies. Some comments and questions arose, for example, that referenced bitcoin as a security despite the asset already being established as a commodity by the Commodity Futures Trading Commission (CFTC).

Figures like Aaron Wright — director of blockchain project Cardozo — took to Twitter to express their thoughts and concerns. Wright says that the hearing was amongst the most significant and fulsome commentaries delivered by the SEC regarding token regulation, but that there was also “superficial appeal” to treating bitcoin and related tokens as securities, as many of them are still seen as “speculative assets.”

“I hope that we don’t [go] down that path,” he wrote. “These types of arguments could conceivably gain legs, given the heavy emphasis by some that tokens in some way mutate. Certain tokens could start as a commodity and then mutate into securities as networks consolidate and begin to exhibit less utility. There’s no logical boundaries for these types of arguments so they become dangerous and likely will have unforeseen consequences.”

On the other hand, nonprofit research and advocacy association Coin Center was very positive about the hearing, commenting that the SEC’s views were generally the “right approach” when it came to examining tokens’ usefulness and decentralization to decide whether tokens were securities or utilities.

“It’s awesome to hear the SEC’S Director of Corporation Finance testify that they are looking at these issues with a similar perspective,” said Peter Van Valkenburgh, the organization’s director of research, on the Coin Center blog.

This article originally appeared on Bitcoin Magazine.