Op Ed: Here’s What Paul Krugman Got Wrong in His Bitcoin Tweetstorm

Like many other mainstream economists, Paul Krugman has long-shown a complete disdain for Bitcoin. In late 2013, he went as far as to write a piece titled “Bitcoin Is Evil” for his column in The New York Times.

Moral objections to bitcoin are one thing, but Krugman also does not see much utility in the cryptoasset at all. While he has been able to express his hatred for Bitcoin quite clearly, his technical criticisms of bitcoin as a new type of asset and store of value leave something to be desired.

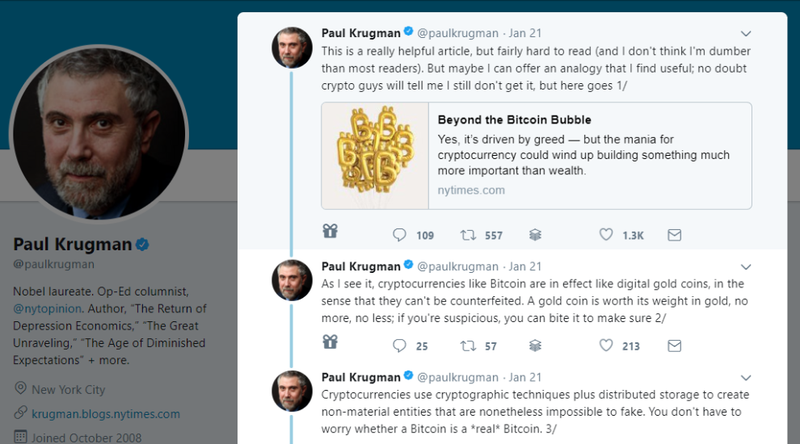

In a tweetstorm on Sunday, January 21, 2018, Krugman illustrated his ignorance on the usefulness and utility of bitcoin around the world.

Starts Out Well Enough With the Digital Gold Analogy

Krugman’s tweetstorm started out well enough. In fact, the opening tweets were likely some of the nicest things the Nobel Laureate has ever had to say about bitcoin.

“As I see it, cryptocurrencies like Bitcoin are in effect like digital gold coins, in the sense that they can’t be counterfeited … Cryptocurrencies use cryptographic techniques plus distributed storage to create non-material entities that are nonetheless impossible to fake,” tweeted Krugman.

Digital gold is still the best analogy to sum up the digital asset’s value proposition, and the utility of bitcoin should become more apparent as the world moves deeper into a cashless society. In a cashless society, bitcoin would become the last financial bastion of freedom in a world where the global financial system is under complete control of governments.

The Avoidance of Trusted Third Parties in Payments Is a Big Deal

After those tolerable first few tweets, Krugman goes off the rails with the claim that online payments that don’t involve a trusted third party aren’t that important.

“Cryptocurrency lets you make electronic transactions; but so do bank accounts, debit cards, Paypal, Venmo etc. All these other methods involve trusting a third party; but unless you’re buying drugs, assassinations, etc. that’s not a big deal,” tweeted Krugman.

First all of all, there’s no reason to bring morals into an exploration of bitcoin’s utility. Either people will use it or they won’t. Whether you like what they’re doing is a different matter. Bitcoin’s use in darknet markets, ransomware, online gambling and other fringe areas cannot be ignored. Utility is utility.

Secondly, not everyone has access to PayPal, Venmo, and other online payment platforms. These options are centralized and permissioned. They’re also highly regulated, which means plenty of people fall through the cracks and cannot gain access to them.

Online freelancers in Venezuela take bitcoin because their government and payment platforms like PayPal have failed them.

Interesting post on /r/Bitcoin from a Redditor who compares the different options for storing value in Venezuela.

"I know a lot of people who sold everything they could to leave the country and took their money to bitcoins through @LocalBitcoins."

https://t.co/dvmxu4ozhV pic.twitter.com/R3egCdmoLa— Kyle Torpey (@kyletorpey) December 1, 2017

Krugman goes on to point out the clunkiness of Bitcoin as it exists today, and he’s generally correct on this front. But this does not mean there’s no utility here. In fact, the opposite is true: There is so much utility that it has become difficult to scale the system to all of the people who want to use it.

Complaining about the lack of cheap, user-friendly payments on Bitcoin today is analogous to someone in 1995 complaining that the internet doesn’t have Netflix. Just give it a minute. Payment layers are currently being built on top of the base Bitcoin blockchain, with the Lightning Network being the most obvious example.

The Claim That Bitcoin Has Nothing to Backstop Its Value

Krugman then turned to the often-used argument that bitcoin lacks any sort of underlying value. This should come as a surprise, since he just laid out how it is useful for illicit digital payments.

“Meanwhile, what backstops a cryptocurrency’s value? Paper money is ultimately backed by governments that will take it in payment of taxes (and central banks that will reduce the monetary base in case of inflation). Gold is actually useful for some things, like filling teeth and making pretty jewelry; that’s not most of its value, but it does provide a tether to reality, along with a 5000-year history,” tweeted Krugman.

“Cryptocurrencies have none of that,” Krugman continued. “If people come to believe that Bitcoin is worthless, well, it’s worthless. Its price rise has been driven purely by speculation — by what Robert Shiller calls a natural Ponzi scheme, in which early entrants make money only [because] others buy in.”

If bitcoin is useful for permissionless digital payments, then it has the same sort of underlying utility that the U.S. dollar has in the form of tax payments.

Additionally, the U.S. dollar would also become worthless if people woke up one morning and came to believe that it was worthless.

Of course, all of this misses the point anyway. How much of the value of all the U.S. dollars in the world comes from its use in tax payments? How much of the value of all the gold in the world comes from its use in electronics? Not much.

Krugman misses that storage of value is also a form of utility, and bitcoin is the most uncensorable, unseizable store of value the world has ever seen. You can walk around with a passphrase in your head that can unlock access to thousands of bitcoins, and no one would be the wiser. Not to mention there is no centralized party that can inflate the supply.

The Point of Market Manipulation

Krugman also touched on the high potential for manipulation in the bitcoin market, pointing to a paper regarding the manipulation of the bitcoin price by now-defunct bitcoin exchange Mt. Gox, as an example.

This is another claim with some basis in reality, but it ignores the massive amounts of manipulation and lack of transparency in the traditional financial system, which is what led to the creation of bitcoin in the first place.

Through the use of cryptographic proofs, bitcoin has the potential to become much more transparent and trustless than the traditional financial system. Bitcoin’s monetary policy is already much more transparent than what goes on at the Federal Reserve. There’s a reason someone put up a “Buy Bitcoin” sign while Federal Reserve Chairwoman Janet Yellen spoke against the need for further audits of the central bank.

Bitcoin exchanges are highly centralized institutions, which opens the door for manipulation. However, these exchanges have also become much more regulated over time. Today, it’s far more difficult to run an exchange at the level of incompetence that was found at Mt. Gox.

The potential for market manipulation should decline as the technology around bitcoin improves. Eventually, more trades may take place on decentralized exchanges, where it’s impossible to fudge the numbers.

In his last tweet from his thread on Sunday, Krugman said it’s unclear if the Bitcoin blockchain — or any blockchain for that matter — is useful.

Around $3 billion worth of bitcoin has been transacted on the Bitcoin network per day this year, according to Blockchain; $75 million worth of bitcoin per day was the norm the day Krugman first published an article on the subject.

Krugman’s arguments, as well as arguments from other well-known economists, have not changed much since 2013, but the Bitcoin network has continued to grow. It’s possible that Krugman and his colleagues are unable to comprehend the usefulness of bitcoin as an asset because it does not fit into the regulated, controlled environment they’ve built their economic and political worldviews around.

Bitcoin cannot be tamed, and they hate that.

This article originally appeared on Bitcoin Magazine.