SEC Director of Corporate Finance: Ether Is Not a Security

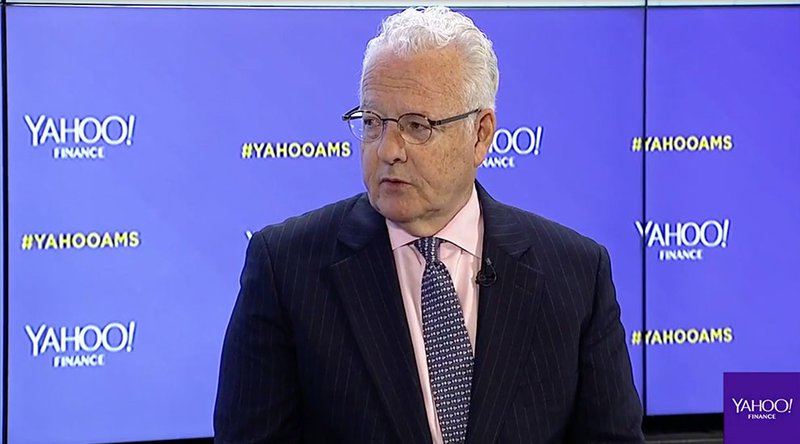

In an informal statement made at Yahoo Finance’s All Market Summit: Crypto, William Hinman, the United States Securities and Exchange Commission (SEC)’s director of corporate finance, indicated that the regulatory agency has no plans to deem ether a security.

“… based on my understanding of the present state of Ether, the Ethereum network and its decentralized structure, current offers and sales of Ether are not securities transactions,” Hinman said in a speech at the summit.

Along with ether, Hinman stated that the SEC would not classify bitcoin as a security, either. Rather, both cryptocurrencies function similar to commodities like gold, silver or oil, the agency believes.

But not all coins are created equal, Hinman expressed in his speech, and the SEC’s leniency on crypto’s top assets won’t relieve tokens from scrutiny. Tokens and Initial Coin Offerings, he continued, are most likely to be considered securities. The distinction lies in how the asset is offered or sold to the public.

“… strictly speaking, the token — or coin or whatever the digital information packet is called — all by itself is not a security … But the way it is sold — as part of an investment; to non-users; by promoters to develop the enterprise — can be, and, in that context, most often is, a security — because it evidences an investment contract,” Hinman stated.

This analysis seems to prioritize circumstance over semantics when deeming a token’s securities status. Projects will often dance around their token’s nomenclature to avoid self-branding as something that could be seen as a security, but Hinman conveyed that the SEC isn’t fooled by the verbal footwork. He made it clear in his speech that “simply labeling a digital asset a ‘utility token’ does not turn the asset into something that is not a security … the economic substance of the transaction always determines the legal analysis, not the labels.”

Hinman appeared to contradict himself when he dove into an analysis of token sales likely falling under the blanket of securities, only to dismiss ether from this classification. But this absolution comes from “putting aside the fundraising that accompanied the creation of Ether,” he said, as a token or coin can’t be deemed a security if no central organization or company is directing it after launch.

“Can a digital asset originally sold in a securities offering eventually be sold in something other than a security?” he posits, eventually concluding that it cannot. “But what about cases where there is no longer any central enterprise being invested in or where the digital asset is sold only to be used to purchase a good or service available through the network on which it was created? I believe in these cases the answer is a qualified ‘yes.’”

The speech shed substantial clarity on a question that has loomed over the industry for some time: namely, whether or not ether would be ruled as a security. And, while this speech is sure to quell the anxieties of enthusiasts and investors alike, it leaves a gray area open for the SEC to color in its treatment of each individual token and coin under Hinman’s interpretation.

Still, the developments are positive for an industry that, in the context of the United States, has made a slow crawl toward regulatory legitimacy.

“We are glad the SEC agrees with our long held analysis of how securities law applies to decentralized cryptocurrency networks like Bitcoin and Ethereum,” Coin Center Executive Director Jerry Brito said in a statement. “We are thrilled to see it take a strong pro-innovation approach to this nascent technology. With this guidance, the SEC is showing that taking a pro-innovation approach does not have to come at the expense of protecting investors.”

While the words carry weight from one of the SEC’s highest officials, it’s worth noting that they were spoken somewhat informally and may not represent a cohesive message across the SEC’s regulatory staff.

This morning, Valerie Szczepanik, the SEC’s first crypto czar, issued what looks like a caveat on this front, stating in a panel at the summit that individual staffer comments may not be wholly in line with the SEC’s official stance.

This article originally appeared on Bitcoin Magazine.